Businesses across various industries in India are leveraging big data nowadays. Thanks to data analysis, businesses enjoy streamlined resources management, a rise in operational efficiencies, big development opportunities, accelerated and smart decision-making as well as improved product development among other benefits.

When it comes to the real estate sector, it is no different. More and more companies, investors, sellers as well as buyers are taking to data in a major way to create algorithm models and predictive analytics to eliminate the guesswork. As a result, they are coming up with more accurate predictions. Furthermore, these estimates provide numerous advantages to the stakeholders.

Here are 5 ways, data analytics is contributing to real estate growth in India:

Digitizing & Automating Real Estate Evaluation

Today, the biggest deal-breaker in the real estate sector would be the price. The present rate or the estimated price in the future of the property assists in determining if it will be the correct investment or not. With the help of real estate data analysis, models can be built using ML algorithms to assess the valuation of any property based on historically relevant details such as the age of the property, location and condition. It can deliver an evaluation within a few seconds for overall consideration.

Optimizing the Buyer-Selection Process

Real estate data analytics India can not only assist you to determine the worth of your property, but it also can aid you to seek the right people who are more likely to be interested in a particular property based on their preferences, location, budget and so forth. Data captured by the buyers can be used to recommend properties that cater to their requirements the most. Similarly, real-estate firms can acquire the information of the buyers who are the correct profile for their offerings, so they can invest the optimum amount of time and energy in potential buyers who are the most serious.

Evaluating & Observing Market Trends

Today, to continue a real-estate business, it is necessary to have the correct understanding of every feature that plays a key role in estimating a property’s value. With the increasing factors, it is very significant to keep up to date and understand all the moves your competitors are making. Data Analytics in India becomes very important in assessing and checking the market trends and comprehending the impact of other factors on real-estate expenditures.

Understanding Patterns to Expect Future Development:

Unlike retail, real estate does establish a specific pattern in its development that typically compliments the local trends, economic stability, demographics, government policies, provisions/subsidies around purchasing real estate, interest rates, and so forth. By making use of data analytics, all these together echo the correlation with the price and aid in uncovering the patterns that assist in estimating the future development of real estate.

Increasing Profits & Decreasing Overall Development Expenses:

Real-estate firms invest their money in land acquisition and then development. Data analytics provides visibility into the valuation of the land to make sure they purchase the land at an optimal rate and development cost can also be managed by tracing how much raw material is required to construct any building space by evaluating the historical data to reduce the wastage which leads to an optimized cost of development. Thanks to the help of data analytics, real-estate firms can predict the value of the property and can sell accordingly to ensure augmented returns on every sale.

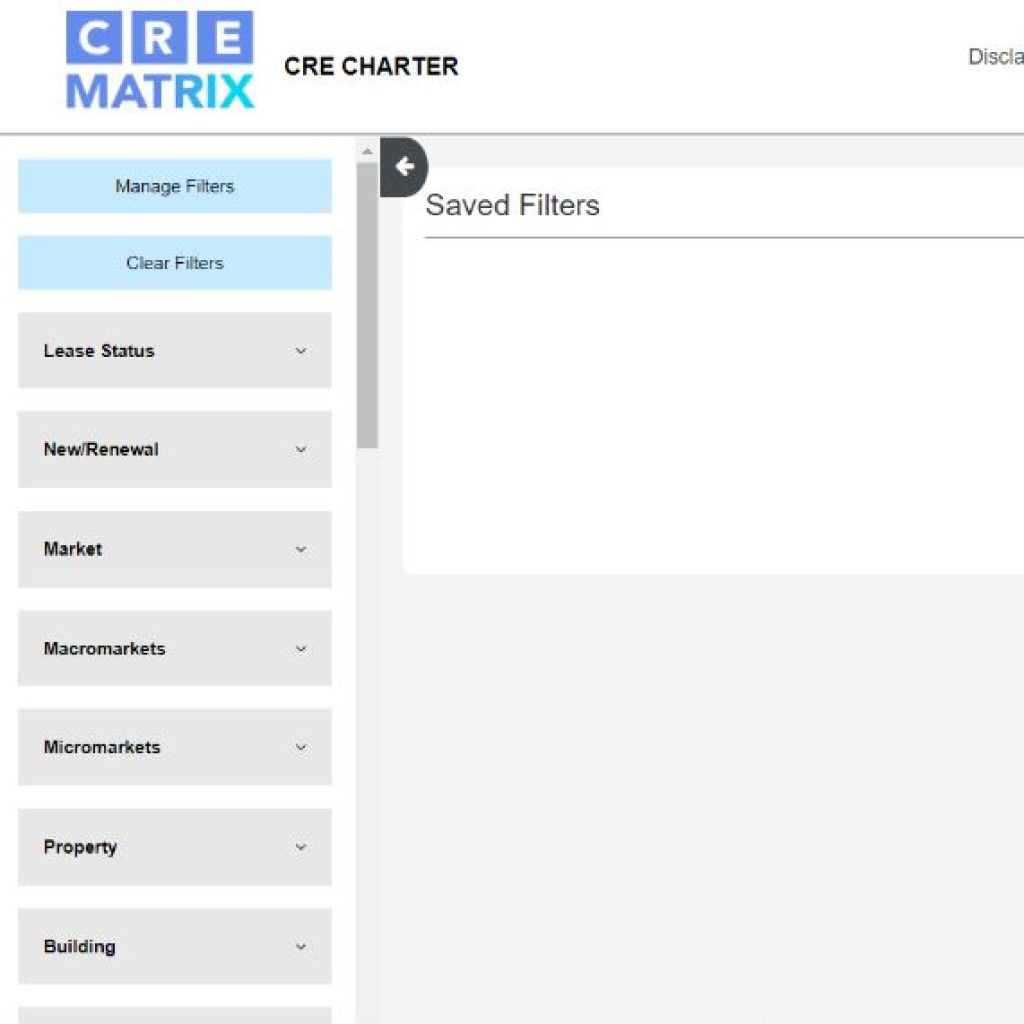

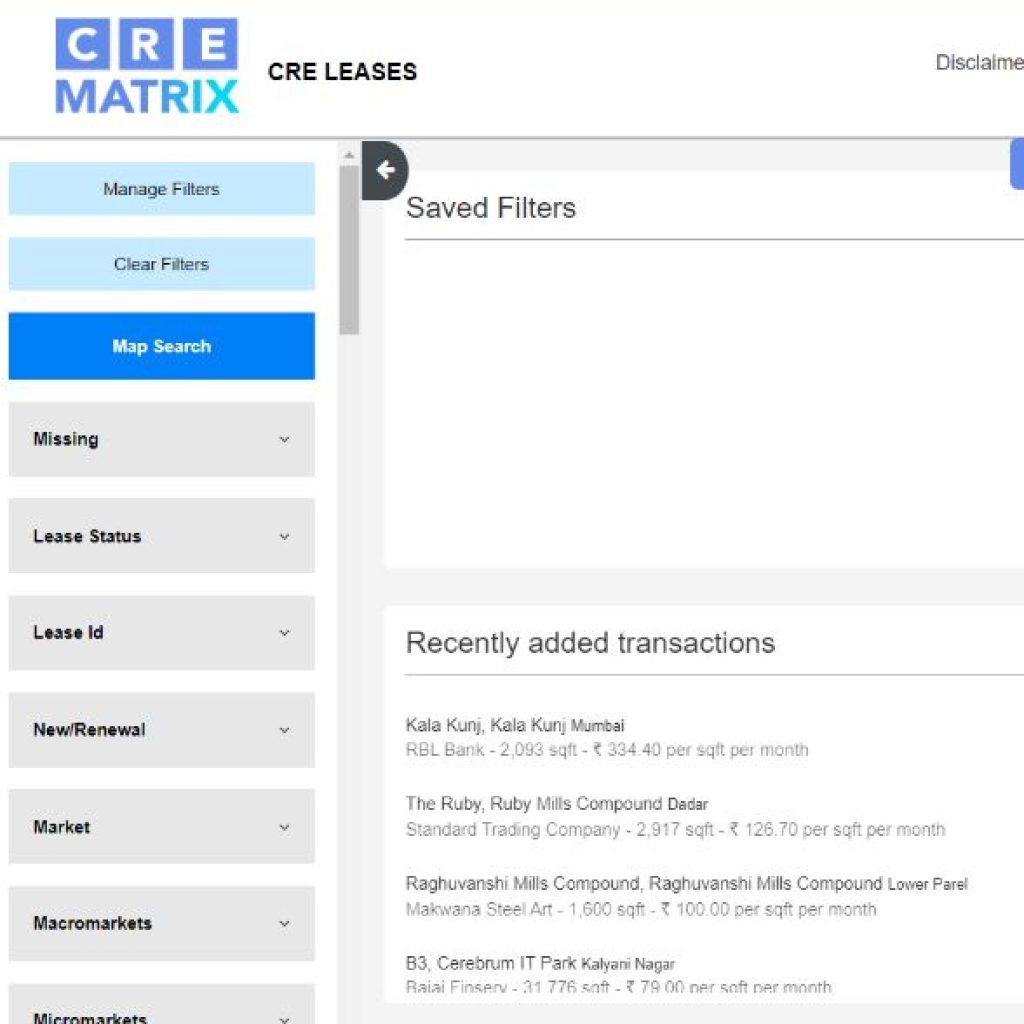

CRE Matrix is a leading real estate data analytics company in India. They make use of data analytics to help stakeholders across different industries make well-informed business decisions.

For more such exciting analysis and details on real estate, visit CRE Matrix.